A credit card is a small plastic card, that allows you to get goods or services without using money. But by using borrowed money, through credit cards, from different banks or financial companies. You will receive a monthly bill with interest, from a bank or financial company for what you have bought. And sometimes some additional charges may also have to pay if you paid the bill after the due date or cross its credit limit. A credit card is a type of payment card in which charges are made against the cardholder’s line of credit instead of his cash deposits. Read this full guide on Credit Card Security tips.

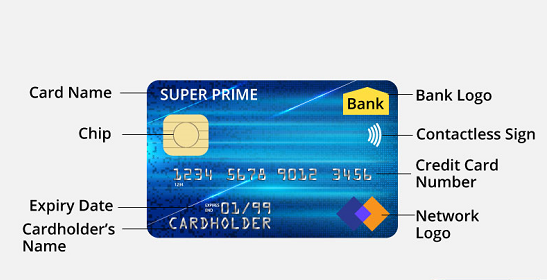

Front side of credit card: Front side of credit card contains:

- Card Name: Banks launches different series of cards and that is mentioned on the card as a name. For example, HDFC Money Back Credit Card.

- Chip: The new cards have a smart chip on the front side that helps in preventing any fraudulent activity.

- Expiry Date: This is mentioned on the bottom of the card. This is the date through which your card remains valid.

- Cardholder’s Name: The name of primary user’s is also mentioned on the front side and at the bottom of the card.

- Bank Logo: It includes the branding of your bank. It can be at the left top or right top of your card.

- Contactless Sign: For the contactless credit card, you would find a sign for the same on the front. You can use contactless credit card just by waiving it near the NFC enables POS machine without swiping the card.

- Credit Card number: This is a unique 16 digits number that identify your account with the bank. In case of Amex Credit card, the card will only have 15 digits. This number is unique for every card. While making online purchases, you need to provide this number.

- Network Logo: Your credit card would belong to any of the four payment networks- Visa, MasterCard, American Express or Discover. Logo of the same will be at the front side of your card.

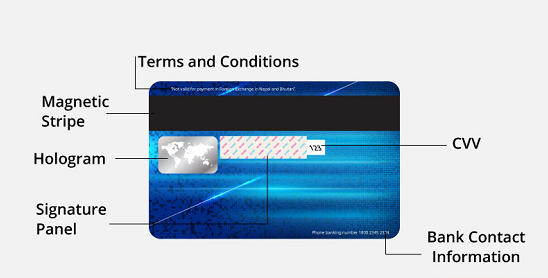

Back side of the Credit Card: Back side of Credit Card contains:

- Terms and Conditions: If your card contains any terms or conditions, then it will be mentioned on the back of the card.

- Magnetic Stripe: This stripe contains your card’s detail and plays an important role in making payment at POS terminals. When you swipe your card, information is sent to the bank through payment network to authorize the transaction.

- Hologram: It is a mirror like hologram on the back side of the card, that usually contains an image printed on it. Which is visible, when you change the viewing angle. This helps merchants to identify the valid credit cards.

- Signature Panel: There is a small panel given under the magnetic stripe, where you are required to sign. You must sign your credit card, before you start to use it.

- CVV: CVV (card verification value) is an additional security code at the back side of your card. You are required to mention it while making online transaction.

- Bank Contact Information: The back side of your credit card contains some contact information of the bank.

Credit cards have a maximum amount or credit limit, the user can use during a given period. The credit limit is predetermined by the card issuer based on the cardholder’s credit rating and credit history.

How to Use a credit card?

There is an agreement of a credit card company with various merchants for them to accept their credit cards. The credit card issuer issues a credit card to their customers. There is a credit line is created for the customer and this line of credit may be used by the customer to make purchases or to get cash advances by using their credit cards as ATM cards. The cardholder receives a monthly bill that can be paid off before the due date without any interest. There may be some additional charges after the due date.

How to use credit card while making offline transaction:

While making a purchase, the cardholder has to swipe the magnetic stripe against the swipe machine. And the merchant copy of the receipt needs the card holder’s sign for validation. Now, the newer card has a more advanced chip and pin system. Chip on the card is read by the merchant’s machine and 6- digit pin is required to validate that transaction.

How to use credit card while making online transaction:

Now at the time of digital marketing, the online shopping industry hugely benefited from the availability of credit cards. For making an online transaction, through a credit card, key information is required for making a transaction including credit card number, card’s expiry date, and CVV number. And a special transaction password or One-time password is sent to the user’s registered mobile number. And the user required that password to complete that transaction.

How we can securely use the credit card:

Nowadays, the use of credit cards is very high, and safety is a very essential part. There is a lot of things you can follow for the safety of your credit card, that is below mentioned:

- Practice basic credit card security: while you get a new card in the mail. It’s to sign the card right away. It protects you, if the card falls in to someone else’s hands. And not store your pin at the same place of credit card. And if you stole your card, then your pin will also be stolen.

- Keep your account number private:

- Always keep your card private. Don’t let anyone to see your card number.

- Don’t give your card’s information on the phone, unless it is a bank or merchant you trust.

- Never answer an email that asks your account number and personal information.

- make paperless statements and make payments online to remove your sensitive information from the postal information.

- Keep your information current: Keep your all information current. Your mobile number is changed, your address is changed, your e-mail is changed. Update all current information immediately, if you don’t want any fraud. Regularly contact with banks or finance company to update your information on file. This way, if anything goes wrong, you can be contacted easily.

- Keep your information current: Keep your all information current. Your mobile number is changed, your address is changed, your e-mail is changed. Update all current information immediately, if you don’t want any fraud. Regularly contact with banks or finance company to update your information on file. This way, if anything goes wrong, you can be contacted easily.

- Be careful with your receipts: It is also a good idea to check your receipts against billing statements to make sure everything adds up.

- Protect yourself online: Now online shopping is more popular than ever. It is important to protect your online information. Try to shop with established businesses, whom you can contact easily, if there is any issue.

Look for sites with https: in their web addresses, where s stands for secures sites. Always make sure you check policies on payments, refunds and shipping. Be sure to keep copies of codes or receipts. - Secure your devices and networks: make sure your computer is equipped with a firewall. Be sure to change the password and keep the firewall on. Keep your devices with most updated security features. Install security software and antiviruses.

- Keep your password secrets: Always keep your passwords secretly. Don’t make such passwords, which can be easily guessed like, family member names. Phone numbers, birth dates etc. don’t use the same passwords for the bank account and retail sites. Change your passwords periodically.

- Check your account often: If your credit card issuer offered an e-mail or text alerts about unusual activity, sign up to receive them.

- Report lost cards and suspected fraud right away: Immediately report your lost cards or any fraudulent activity to the credit card issuer or to the banks, or to the companies. So, they can immediately block your credit card and account number to protect you further. Then they will give you a new card and account number.

In this way, a credit card is very beneficial to you. But if you use your card with all safety guards. You can protect yourself from any fraud and can get high benefits from it. Security is a must while you use your credit cards. Credit card companies or banks always help you against any fraudulent activity. You only have to keep them informed. Follow all the above instructions and use your cards freely.